Managerial Accounting Assignment

Managerial Accounting Assignment

Assignment Questions:

1. In the context of this course, you will be asked to address the issues/questions below for Apple Inc. (AAPL).When addressing the issues/questions, be sure to do so in the context of this course and Apple. You have been appointed as the special assistant to the Chief Executive Officer, Timothy Cook who has asked you to address the following two situations:

a) Apple currently buys most of its store equipment from a manufacturer in China. A representative from a company in Malaysia is offering to sell the equipment for 25% less than the cost from the manufacturer in China. Discuss the issues that you would consider in deciding whether to accept this offer.

b) Mr. Cook wishes to develop an incentive plan for the retail store managers. Before the plan is implemented, he wishes you to make sure that budgeting for the stores is done correctly.

ORDER A PLAGIARISM-FREE PAPER HERE

He has asked you to submit a document, which discusses the key points related to budgeting that you have learned in MBA 640. Be as thorough as possible.

2. The Butler Refrigeration Co. purchases and installs defrost clocks in its products. The clocks cost $180 per case, and each case contains 12 clocks. The supplier recently gave advance notice that effective in 60 days; the price will rise by 50 percent. The company has idle equipment that, with only a few minor changes could be used to produce similar defrost clocks. Managerial Accounting Assignment

Cost estimates have been prepared under the assumption that the company could make the product itself. Direct materials would cost $120 per 12 clocks. Direct labor required would be 15 minutes per clock at a labor rate of $20.00 per hour. Variable manufacturing overhead would be $6.00 per clock. Fixed manufacturing overhead, which would be incurred under either decision alternative, would be $60,000 a year for depreciation and $300,000 a year for other costs. Production and usage are estimated at 120,000 clocks a year. (Assume that any idle equipment cannot be used for any other purpose.)

Prepare an analysis that indicates whether the defrost clocks should be made within the company or purchased from the outside supplier. In your analysis, be sure to include the unit cost to make one clock and to buy one clock. Also, discuss any relevant qualitative factors.

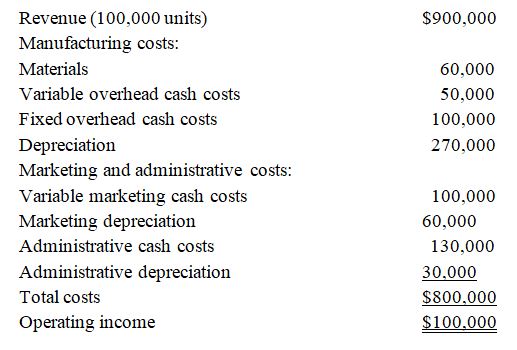

3. The following information is available for 2020 for Robinson Products:

All depreciation charges are expected to remain the same for 2021. Sales volume is expected to increase by 25 percent, but prices are expected to fall by 8 percent. Material costs are expected to decrease by 4 percent. Variable manufacturing overhead cash costs are expected to decrease by 5 percent. Fixed manufacturing overhead cash costs are expected to increase by 10 percent.

Variable marketing cash costs change with volume. Administrative cash costs are expected to increase by 10 percent. Inventories are kept at zero. Managerial Accounting Assignment

Required:

Prepare a budgeted income statement for 2021. Round budget line items to the nearest dollar.

4. Dragon Corporation began operations in July and manufactured 50,000 units during the month with the following unit costs:

Direct materials $8.00

Direct labor 5.00

Variable overhead 4.00

Variable marketing cost 3.00

The total fixed factory overhead is $500,000 per month. During July, 40,000 units were sold at a price of $50, and fixed marketing and administrative expenses were $200,000.

Required:

- Calculate the unit product cost of each unit using absorption costing and variable costing.

- Prepare a variable costing income statement for Dragon Corporation for the month of July.

- Explain how variable costing differs from absorption costing.

5. Iggy Corporation prepared a budget last period that called for sales of 40,000 units at a price of $30 each. The costs per unit were estimated to amount to $15 variable and $8 fixed. During the period, production was equal to the actual sales of 45,000 units. The selling price was $28.00 per unit. Variable costs were $16.00 per unit. The fixed costs actually incurred were $310,000.

Required:

- Prepare a report to show the difference between the actual contribution margin per the static budget and the budgeted contribution margin per the flexible budget.

- Explain the significance of the comparisons.

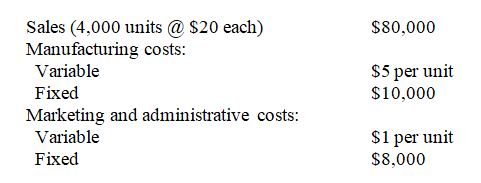

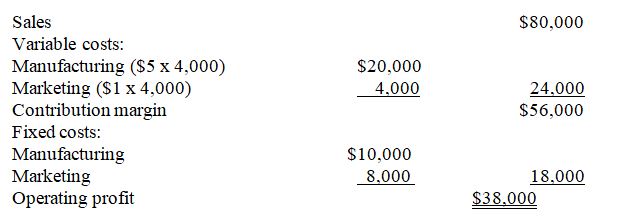

6. BAM Inc. has the capacity to produce 5,000 units per year. Its predicted operations for the year are as follows:

The accounting department has prepared the following projected income statement for the coming year for your use in making decisions. Managerial Accounting Assignment

Required

- Should the company accept a special order for 500 units at a selling price of $9? Assuming that there are no variable marketing and administrative costs for this order and that regular sales will not be affected, what is the impact of this decision on company profits?

- Suppose there was a one-time setup fee of $1,000 for the preceding order. Should the special order be accepted? Why?

- What other factors should be considered and how would they affect your decision to accept the special order?

7. Riley Corporation manufactures and sells oil filters. The selling price for these oil filters is $8.00, which is what Riley’s competitors charge, as the oil filter is a commodity. Facts for Riley are as follows:

- Riley desires a 25 percent return on its total assets, which are $3,000,000.

- Riley has a current sales volume of 500,000 units.

- Variable costs are $3.00 per unit, $2.00 for manufacturing, and $1.00 for marketing and administrative costs.

- Fixed costs are $900,000.

Required:

- Can Riley achieve its desired profit?

- Suppose that Riley follows a strategy of one of its competitors, which is to spend $200,000 on advertising so that there is more brand awareness. This would permit them to raise the selling price to $10.00 but their sales volume would decrease to 450,000 units. Will Riley achieve its desired profit?Managerial Accounting Assignment

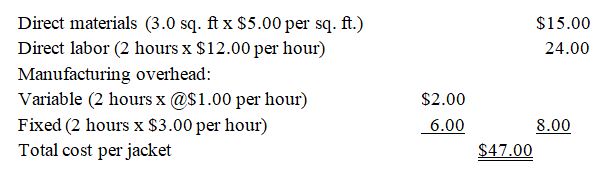

8. Robinson Corporation manufactures embroidered jackets. The company prepares flexible budgets and uses a standard cost system to control manufacturing costs. The following standard unit cost of a jacket is based on the static budget volume of 15,000 jackets per month.

Data for November of the current year include the following:

- The actual production was 16,000 jackets.

- Actual direct materials usage was 2.80 square feet per jacket at an actual cost of $5.50 per square foot.

- The amount of actual direct materials purchased was 50,000 square feet.

- Actual direct labor usage of 33,000 hours cost $445,500.

- Total actual overhead cost was $120,000; $36,000 was variable.

Requirements:

- Compute the eight variances discussed in class.

- Robinson’s management intentionally purchased superior materials for November production. How did this decision affect the other cost variances? Overall, was the decision wise? Explain

Managerial Accounting Assignment